estate tax exclusion amount sunset

Ask a tax Expert. 2 In addition the 40.

Preparing For The 2025 Tax Sunset Creative Planning

On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from.

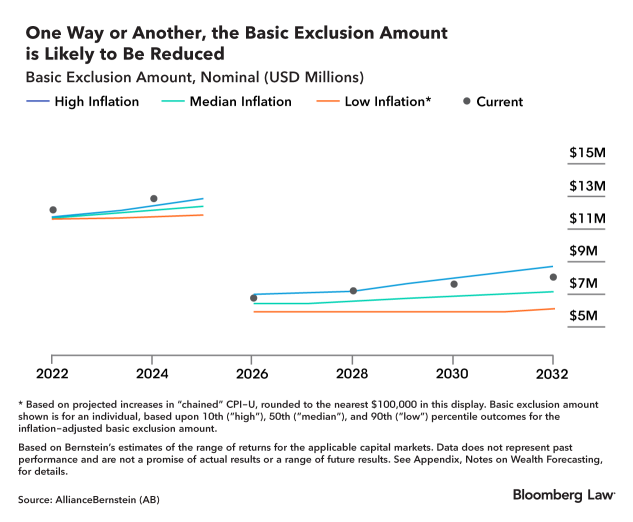

. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. Projections for the post. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. 1 2026 the federal. Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2.

The exemption amount will be cut in half for each taxpayer and is estimated to be around 62 million in 2026. Individuals can transfer up to that amount without having to worry about federal estate taxes. The current exemption was doubled.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Thanks email protected Submitted. However the TCJA will sunset on Dec.

That the Gross Estate is less than the applicable exclusion amount for the year in which the decedent died therefore said Estate is not subject to the Federal Estate Tax. OR The Estate undertakes to pay any and all Federal Estate tax due or to become due. Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president.

Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president. Making large gifts now wont harm estates after 2025. Additionally the exclusion places a cap on the dollar amount you may claim.

After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. Settling a loved ones estate can be time consuming. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million.

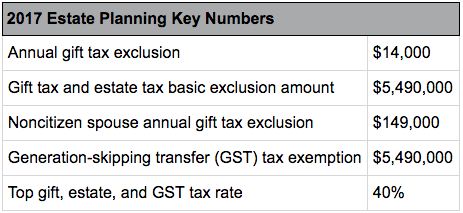

For 2017 the federal amount exempted from death taxes is 549 million and the top federal estate tax rate is 40 percent she said. The estate tax exemption is often adjusted annually to reflect changes in inflation every year. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. This piece of mind however severely decreases after December 31 2025.

Under the TCJA the exemption was doubled from 5 million to 10 million indexed for inflation while retaining the portability provision and the top 40 tax rate. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Were here to make it easier. With inflation this may land somewhere around 6 million. Ad ClearEstate Can Save estate executors up to 120 hours and 8500 in fees.

Ask Your Own Tax Question. The current estate tax exemption is 12060000 and double that amount for married couples. Projections for the post.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. The federal estate tax exemption for 2022 is 1206 million. We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable.

The Build Back Better bill thats been bouncing. The answer is more complicated for New Jerseys estate tax. NJ for graduate study fees.

The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. After 2025 the exemption amount will sunset a fancy way of saying end back to the pre-TCJA levels. If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount.

Estate taxes from 2010 through 2012 were based on the Tax. The estate tax due would be zero. A married couple may exclude as much as 500000 provided that each of them meets the ownership and residency.

549M for individuals and 1098M for married. In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. This gives most families.

Can I claim this amount for tax exemption. A single taxpayer can only exclude 250000 of profit on the sale of the home. Connect one-on-one with 0.

What happens to estate tax exemption in 2026. What happens to estate tax exemption in 2026. This set the stage for greater increases in years to come.

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

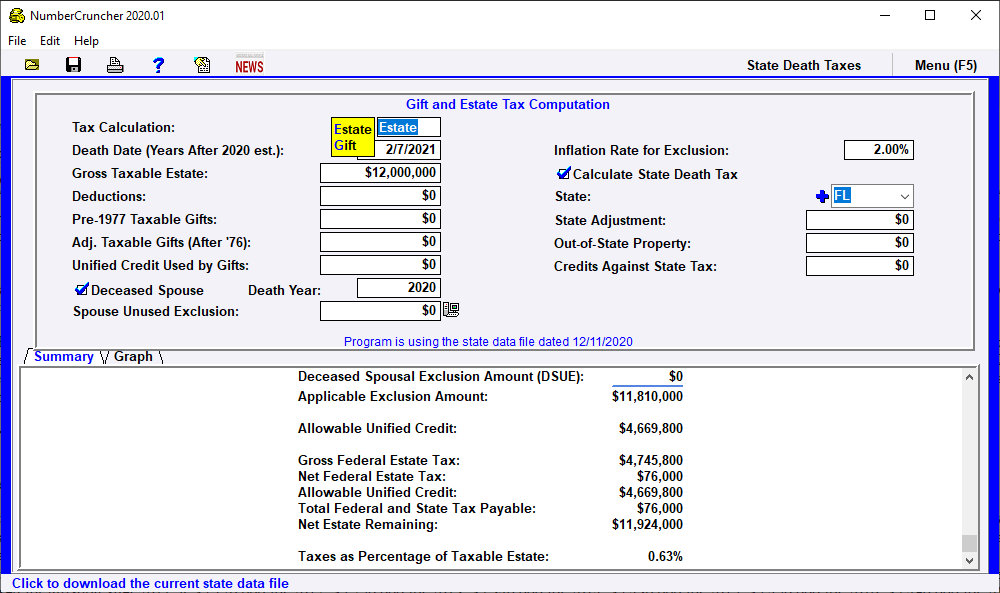

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

Start Planning Now For A Higher Tax Environment Pay Taxes Later

To Port Or Not To Port Is Filing For Portability Right For You Bartlett Pringle Wolf Santa Barbara Accounting Tax Audit Services

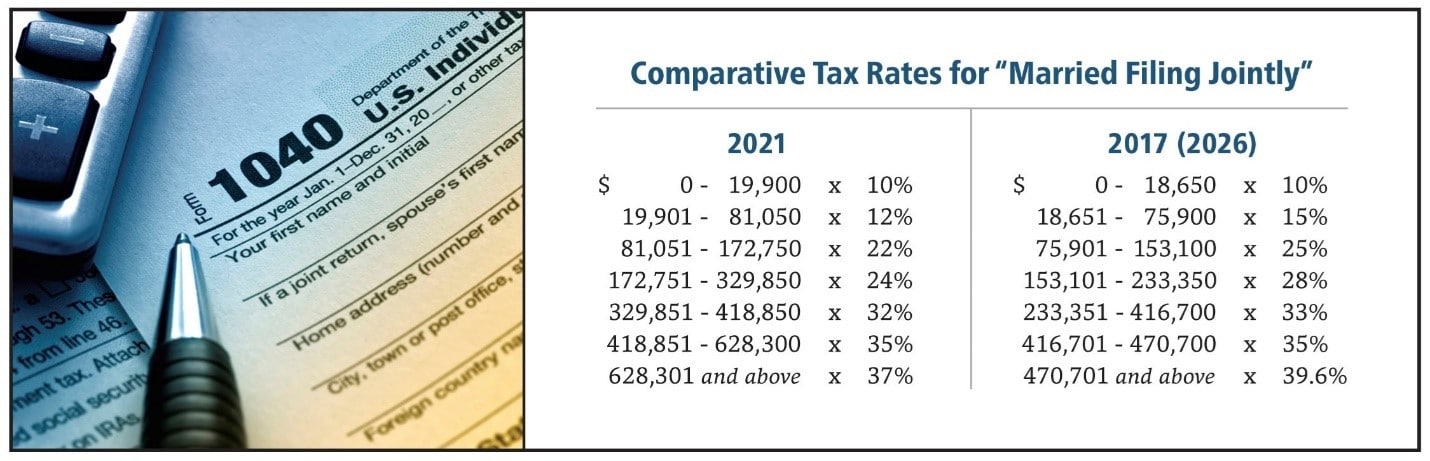

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Four More Years For The Heightened Gift And Tax Estate Exclusion

An Evaluation Of The Future Of Federal Estate Tax Koss Olinger

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

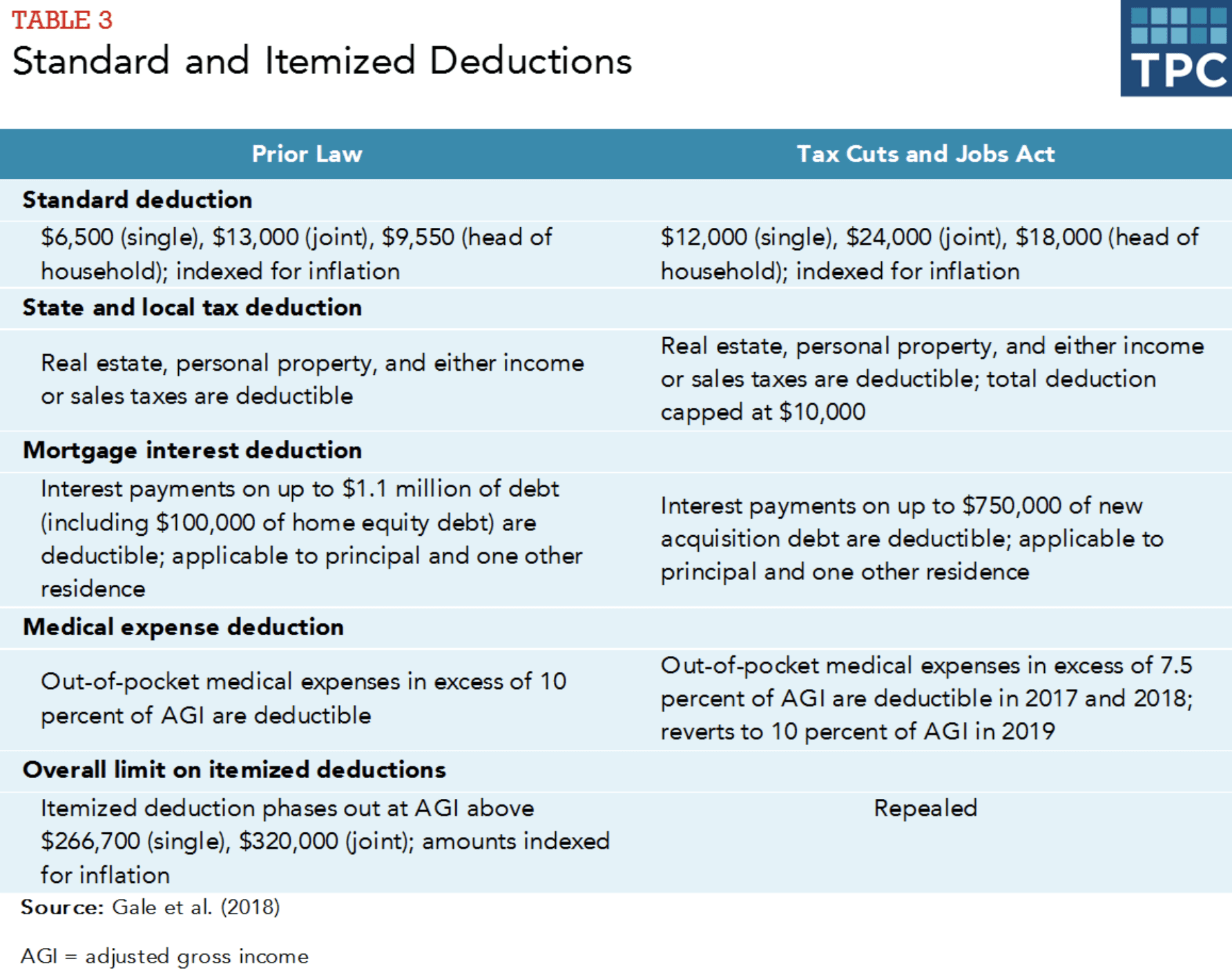

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Four More Years For The Heightened Gift And Tax Estate Exclusion

Estate Tax Current Law 2026 Biden Tax Proposal

Do You Pay Tax On An Inheritance

Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire

The Case For Wealthy Clients Using Their Gift Tax Exemptions Now Financial Planning

Final Tax Bill Includes Huge Estate Tax Win For The Rich The 22 4 Million Exemption